[ad_1]

The global xEV (BEVs, PHEVs, HEVs) battery market continues to expand at a very high speed, more than doubling year-over-year in July.

According to SNE Research, the total battery capacity installed in passenger xEVs registered in July amounted to 20.7 GWh, which is 113% more than a year ago.

The number includes only battery capacity deployed in new passenger cars (buses and trucks are excluded).

As we can see, CATL remains the top player in the xEV battery market with 6.1 GWh (up 236%) and over 29% market share!

LG Chem’s LG Energy Solution also notes high volume, but the year-over-year growth is not as high – 5.1 GWh (up 81%).

The highest growth rate is noted by the Chinese manufacturers like CATL, BYD and CALB. Panasonic’s growth rate is relatively weak.

- CATL – 6.1 GWh (up 236%) with 29.3% share

- LG Chem’s LG Energy Solution – 5.1 GWh (up 81%) with 24.5% share

- Panasonic – 2.5 GWh (up 47%) with 11.9% share

- BYD – 2.0 GWh (up 331%) with 9.6% share

- SK Innovation – 1.2 GWh (up 81%) with 5.8% share

- Samsung SDI – 1.0 GWh (up 14%) with 4.7% share

- CALB – 0.7 GWh (up 357%) with 3.6% share

- Guoxuan – 0.4 GWh (up 76%) with 1.9% share

- Envision AESC – 0.3 GWh (down 7%) with 1.3% share

- PEVE – 0.2 GWh (up 18%) with 1.1% share

other – 1.3 GWh (up 128%) with 6.4% share

Total – 20.7 GWh (up 113%)

Year-to-date, more than 126 GWh (up 154%) of batteries were deployed globally in new passenger xEVs.

CATL is slightly ahead of LG. Panasonic is in the middle between the two leaders and the rest of the group, led by BYD.

- CATL – 34.2 GWh (up 280%) with 27.1% share

- LG Chem’s LG Energy Solution – 33.1 GWh (up 152%) with 26.2% share

- Panasonic – 19.6 GWh (up 66%) with 15.5% share

- BYD – 9.0 GWh (up 275%) with 7.2% share

- Samsung SDI – 6.9 GWh (up 88%) with 5.4% share

- SK Innovation – 6.4 GWh (up 143%) with 5.1% share

- CALB – 3.9 GWh (up 323%) with 3.1% share

- Envision AESC – 2.2 GWh (up 12%) with 1.8% share

- Guoxuan – 2.2 GWh (up 206%) with 1.7% share

- PEVE – 1.5 GWh (up 34%) with 1.2% share

other – 7.2 GWh (up 213%) with 5.7% share

Total – 126.2 GWh (up 154%)

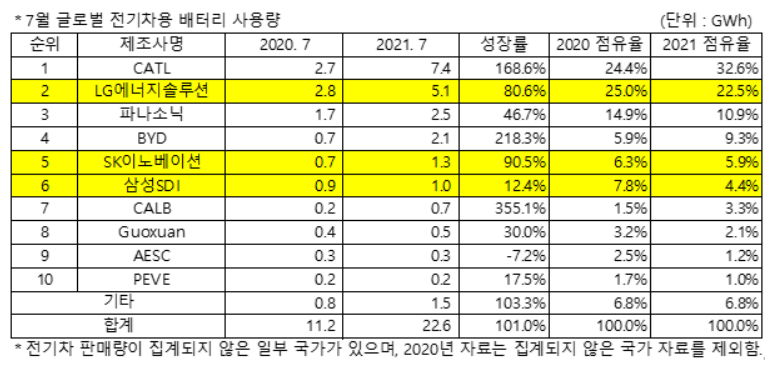

If we include the commercial vehicles, like buses and trucks, the total battery capacity deployed is even higher – 22.6 GWh (up 101%) in July. Passenger cars stand for close to 92% of all xEV batteries.

- CATL – 7.4 GWh (up 169%) with 32.6% share

- LG Chem’s LG Energy Solution – 5.1 GWh (up 81%) with 22.5% share

- Panasonic – 2.5 GWh (up 47%) with 10.9% share

- BYD – 2.1 GWh (up 218%) with 9.3% share

- SK Innovation – 1.3 GWh (up 91%) with 5.9% share

- Samsung SDI – 1.0 GWh (up 12%) with 4.4% share

- CALB – 0.7 GWh (up 355%) with 3.3% share

- Guoxuan – 0.5 GWh (up 30%) with 2.1% share

- Envision AESC – 0.3 GWh (down 7%) with 1.2% share

- PEVE – 0.2 GWh (up 18%) with 1.0% share

other – 1.5 GWh (up 103%) with 6.8% share

Total – 22.6 GWh (up 101%)

Year-to-date xEV battery deployment amounted to 137.1 GWh (up 144%). 92% fall on passenger xEVs.

- CATL – 41.2 GWh (up 218%) with 30.0% share

- LG Chem’s LG Energy Solution – 33.2 GWh (up 152%) with 24.2% share

- Panasonic – 19.6 GWh (up 66%) with 14.3% share

- BYD – 10.0 GWh (up 207%) with 7.3% share

- SK Innovation – 7.4 GWh (up 148%) with 5.4% share

- Samsung SDI – 7.0 GWh (up 87%) with 5.1% share

- CALB – 3.9 GWh (up 322%) with 2.8% share

- Guoxuan – 2.6 GWh (up 156%) with 1.9% share

- Envision AESC – 2.2 GWh (up 12%) with 1.6% share

- PEVE – 1.5 GWh (up 34%) with 1.1% share

other – 8.5 GWh (up 159%) with 6.2% share

Total – 137.1 GWh (up 144%)

[ad_2]

Source link